is amex savings fdic insured ,The Federal Deposit Insurance Corporation (FDIC) is an independent organization of the United States government that protects you from losing your insured deposits if an FDIC-insured bank or savings association fails. American Express National Bank is an FDIC-insured bank, so your deposits are protected as long as they do not exceed the permitted coverage limits.

is amex savings fdic insured , American Express National Bank, Member FDIC, provides a variety of savings options, including savings accounts with high interest rates and certificates of deposit (CDs).

If you’re thinking about opening a new account to save your extra cash, you are probably wondering how your American Express savings rates compare.

The good news is that American Express’s rates are quite competitive, as is customary for online savings accounts.

Here’s an additional glance at what the American Express savings account offers. Rates and account information are correct as of April 25, 2024.

American Express Savings Account Interest Rates

American Express provides a high-yield savings account that has no fees and no minimum balance limitations. The savings account receives the same rate at all balance tiers.

Here is the current savings rate for the American Express® High Yield Savings Account.

| Account Name | Annual Percentage Yield (APY) | Minimum Deposit |

|---|---|---|

| American Express® High Yield Savings Account | 4.25% | $0 |

What Funds Are Included In FDIC Coverage?

FDIC deposit insurance covers depositors’ account balances up to the insurance limit, including principal and interest. FDIC tools, like the Electronic Deposits Insurance Estimator (EDIE), help understand coverage and allow users to print reports for records.

What is FDIC Coverage Limit?

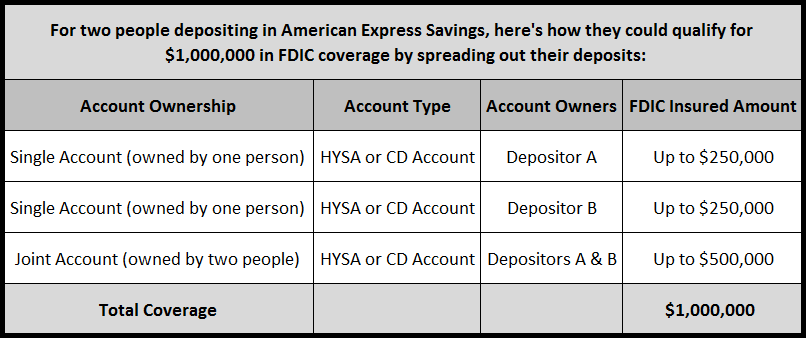

Depositors at American Express National Bank who have accounts in different ownership types (such as “individual” and “joint” accounts) may be eligible for coverage of more than $250,000.

Description of American Express Savings Accounts.

American Express has no minimum deposit requirements, which may be enticing if you’re just starting out with savings.

American Express offers a low deposit and no monthly fees for its savings account, which is managed online or via the American Express mobile app.

Here are a few additional key features to note about this savings account:

Depositing Options

- Transfers from linked checking account or check.

- FDIC-insured savings up to $250,000 per depositor.

- 24/7 customer service available.

This account does not come with a card for an ATM therefore to withdraw money, you must link an external examining account and transfer your funds there, which can take between one and two working days. If you have an American Exchange personal checking account, you can link it to your savings account to make transfers more convenient.

American Express Account Opening Process

- Simple online application with basic information required.

- Name, address, date of birth, and Social Security number provided.

- Linking external bank account required for initial deposit.

- Customer service available at 1-800-446-6307 for account issues or questions.

How Much Cash Can You Make with an American Express Savings Account?

Savings accounts can help you increase your money, but the rate at which this happens is determined by the Annual Percentage Yield (APY) you earn. So, how much can you make with the American Express savings account interest rates?

To discover how much you could make over a specific time period, enter your initial deposit, monthly commitment, and 4.25% Annual Percentage Yield (APY) into the calculator below. You can experiment with different monthly contributions to see how raising your savings amount would pay off.

Overall, American Express savings rates are impressive and far exceed the 0.01% or 0.02% APY you’ll often find at traditional banks.

How the American Express Savings Account Measures Up

American Express offers competitive savings account rates, with the national average interest rate at 0.46%. Its high-yield savings account has no minimum balance requirement and no monthly fees.

However, it doesn’t have physical branches or a full suite of financial products. Comparing rates and features at other banks is essential to find the best option for your needs.

Additional Opportunities to Save with American Express

American Express offers certificate of deposit (CD) accounts with higher rates than its high-yield savings account. Available in terms of 6, 11, 12, 18, 24, 36, 48, and 60 months, with the highest APY at 4.50%. No minimum deposit or monthly fees.

About FDIC

The FDIC guarantees deposits, audits and supervises financial institutions to ensure their safety, soundness, and consumer protection, resolves big and complex financial institutions, and administers receiverships.

FAQS

Is American Express a suitable high-yielding savings account?

American Express is a terrific high-yield savings account option if you want a competitive rate with no monthly fees or minimum balance requirements. American Express savings rates are substantially greater than the national average and those offered by most traditional banks.

is amex savings fdic insured

Here are a few of greater significance qualities to consider regarding this savings account: Deposit funds via transfer from a connected savings account or by cheque. Saving balances are FDIC insured up to $250,000 per depositor and account type. Savers can contact customer support at any time of day or night.Six days ago.

Is the American Express savings account safe?

Because American Express National Bank is an FDIC-insured bank, your savings are protected as long as they don’t go above the maximum amount of permitted coverage. What’s the Limit of My Coverage?